ECONOMY

The Economy: When We Last Entered a Land War on the Asian Mainland

- By fromermedia@gmail.com

- . March 1, 2026

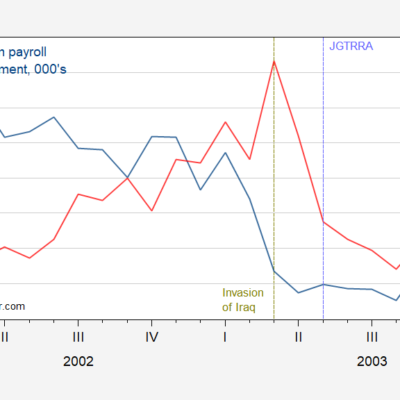

Employment fell as EPU rose; production stalls as Geopolitical Risk spiked. Figure 1: Nonfarm payroll employment, 000’s (blue, left log

Greg Mankiw’s Blog: Economic Theory Summer Camp

- By fromermedia@gmail.com

- . February 26, 2026

About Me Name: Greg Mankiw Location: United States I am the Robert M. Beren Professor of Economics at Harvard University.

Podcast with Jake Sullivan and Jon Finer

- By fromermedia@gmail.com

- . February 23, 2026

Mostly about geopolitics, plenty of fresh content. And here is the transcript. Excerpt: Jon Finer: Should the United States be

Brazil facts of the day

- By fromermedia@gmail.com

- . February 20, 2026

Pensions cost the government 10% of GDP. If no reforms are made by 2050, Brazil will spend more on pensions

Minimum wage hikes and robots

- By fromermedia@gmail.com

- . February 17, 2026

This paper studies how minimum wage policy affects firms’ adoption of automation technologies. Using both state-level measures of robot exposure

Those new service sector jobs

- By fromermedia@gmail.com

- . February 14, 2026

Who needs to be a programmer, be hired to close the doors on Waymo vehicles: Or see here. And more

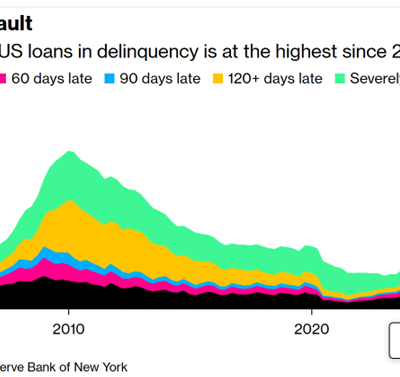

Households under Debt Stress: Two Pictures

- By fromermedia@gmail.com

- . February 11, 2026

From Bloomberg: Auto ABS prices, from Fitch: Source link

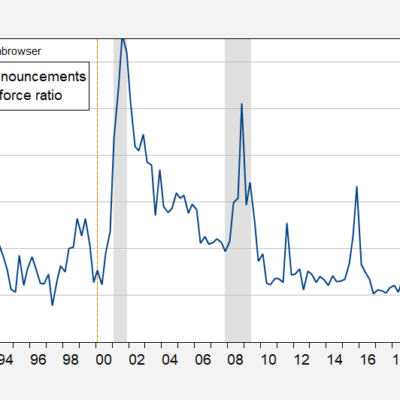

The Layoff Announcement-Labor Force Ratio and Recessions, 1989-2025

- By fromermedia@gmail.com

- . February 8, 2026

Using Challenger, Gray, Christmas data at quarterly frequency, normalized by civilian labor force. Figure 1: Challenger layoff announcements to civilian

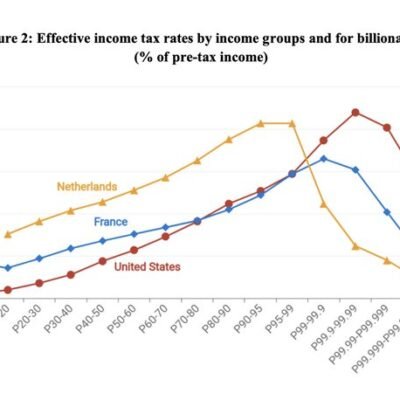

Effective tax rates for billionaires

- By fromermedia@gmail.com

- . February 5, 2026

Here is the tweet, here is the source data. The post Effective tax rates for billionaires appeared first on Marginal

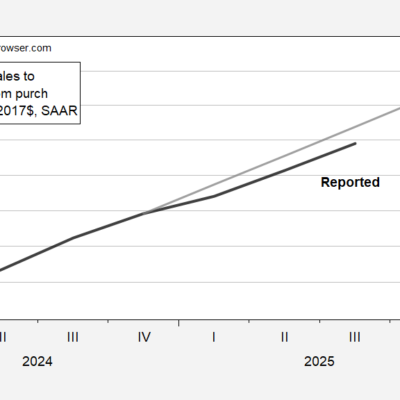

Nowcasting “Core GDP” | Econbrowser

- By fromermedia@gmail.com

- . February 2, 2026

From Atlanta Fed and Goldman Sachs, numbers that perhaps better represent the trajectory of aggregate demand. Figure 1: Final sales