olcayduzgun/iStock via Getty Images

Today, we are going to have a conversation about value. Specifically, finding value through differentiation or offering something unique. Typically, under the hood of every sales pitch lies the “value proposition.” To best communicate what a value proposition is to readers, I looked for a definition. I found one in particular that I like…

“A value proposition is a simple statement that summarizes why a customer would choose your product or service. It communicates the clearest benefit that customers receive by giving you their business. Every value proposition should speak to a customer’s challenge and make the case for your company as the problem-solver.”

A value proposition is the core component of any sales pitch and needs to communicate the ‘why’ behind a product, service, or in today’s case, investment. Different investments have different value propositions. For example, many funds from Vanguard differentiate themselves as being cheap, undercutting opponents on fees. Some funds offer something different entirely. In the case of today’s topic, tax efficiency. Let’s look at a fund with an extraordinarily compelling value proposition…which unfortunately just cracked.

The topic of today’s discussion is the Alpha Architect 1-3 Month Box ETF (BATS:BOXX).

What is Alpha Architect 1-3 Month Box ETF?

BOXX is a unique ETF which brings a unique approach. To explain concisely, the fund is designed to match the return of 1-3 month treasuries through an options strategy called box spreads. Before moving forward, what is a box spread?

Box Spreads

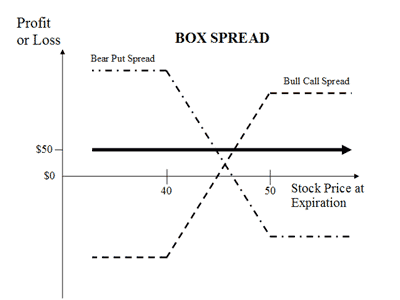

Corporate Finance Institute

Box spreads are an options strategy designed to create a ‘risk-free’ return. We added quotations because there is no such thing as a free lunch, or in this case, a return without risk. A box spread involves combining a bear put and bull call spread with the same expiration dates. The Corporate Finance Institute provides the following concise explanation of the risks & benefits.

Box spreads are vertical and almost entirely riskless. (Vertical spreads are spread with the same expiration dates but different strike prices). Sometimes referred to as neutral strategies, box spreads capitalize on bull call and bear put spreads. The profit for the trader is always going to be the difference between the total cost of the options and the spread between the strike prices, which determines the expiration value of the option spreads.

Box spreads are a form of arbitrage providing a virtually risk-free return which is modest. Under the condition that opening the spread costs less than the expiration value, the investor will make a small profit. An analogy to this type of transaction is a zero coupon bond. The lower the cost of opening the box, the higher the “interest rate” of the transaction.

Despite being virtually risk-free, any options strategy involves accepting certain risks. In the case of BOXX, the fund provides the following overview of options risk:

Box Spread Risk. A Box Spread is a synthetic bond created by combining different options trades that have offsetting spreads (e.g., purchases and sales on the same underlying instrument, such as an index or an ETF, but with different strike prices). Counterparty Risk. Counterparty risk is the risk that a counterparty to a financial instrument held by the Fund may become insolvent or otherwise fail to perform its obligations, and the Fund may obtain no or limited recovery of its investment, and any recovery may be significantly delayed. Equity Securities Risk. Investments in securities whose performance is linked to that of equity securities, such as SPX Options, may fluctuate in value in response to many factors, including the activities of the individual issuers included in the Index, general market and economic conditions, interest rates, and specific industry changes. Such price fluctuations subject the Fund to potential losses.

Knowing how box spreads work, let’s return to the assessment of BOXX.

Why Invest In Box Spreads Through BOXX?

Box spreads are an attractive investment due to their riskless profile. The options market is reliable enough to clear transactions, meaning the execution risk is virtually nil. This means that box spreads are often considered a comparable alternative to short-term cash equivalents, earning a similar total return.

However, BOXX offers another significant value proposition to investors. Not only is the fund utilizing a low-risk strategy which correlates to interest earning treasury bills, the fund is tax advantaged.

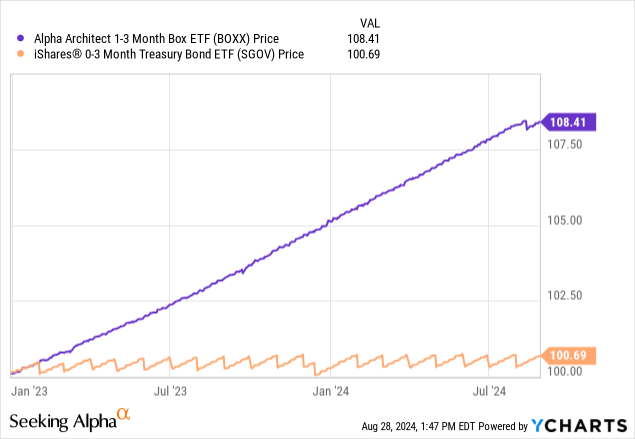

In the case of BOXX, tax efficiency is the first item on the fund’s home page. The primary value proposition of BOXX is not the fund’s return profile, which is commensurate with a money market fund or short-term treasury ETF such as iShares® 0-3 Month Treasury Bond ETF (SGOV). Instead, BOXX is supposed to deliver this value to shareholders in a tax-deferred package.

The tax efficiency of BOXX was the primary driver. Investors were to be able to secure a money market equivalent return without incurring the current tax burden of taking the interest income. For investors with a large tax consequence, this is compelling, given interest income is subject to disadvantageous tax rules. For BOXX shareholders, they could hold shares of the fund and BOXX would accumulate.

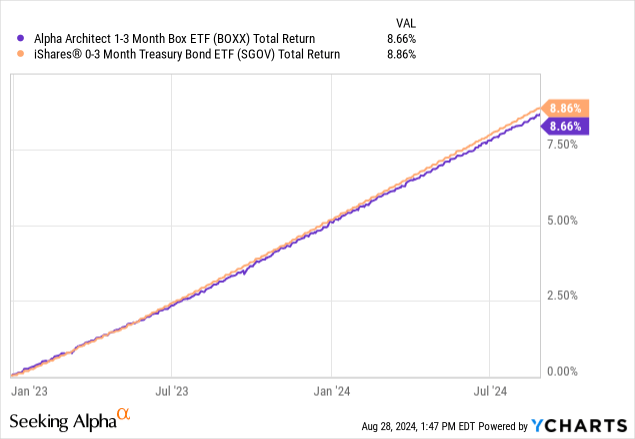

This strategy was largely successful, and BOXX and SGOV have similar total return profiles over the life of BOXX. However, this critical piece of BOXX’s puzzle has broken down.

BOXX Declares A Distribution

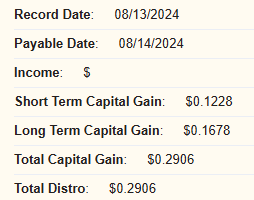

Typically, we celebrate dividends and distributions! Receiving cash in your account is a wonderful feeling…unless your investment was designed not to distribute taxable income. Paid on August 14, BOXX declared a distribution of $0.2906 per share. This distribution was comprised of $0.1228 and $0.1678 per share of short-term and long term capital gains, respectively.

BOXX Fact Card

The declaration of a taxable distribution is a significant blow to the fund’s value proposition. Now, to put this in perspective, the tax liability is tiny, representing around a 25 basis point taxable distribution, most of which is long term capital gain. This means the effective liability is small and insufficient to materially alter BOXX’s return profile. Net of the distribution, BOXX still offers tax advantages relative to a money market fund.

Nonetheless, this is a critical example of a fund charting new territory. Box spreads are not new, however BOXX is a new fund operating for just several years. BOXX came out with high hopes, and investors flocked on the promise of a tax-efficient investment providing synthetic interest income. Thus far, BOXX is ahead of the competition, keeping most of the gains internalized, but the distribution is an example of the best laid plans going awry.

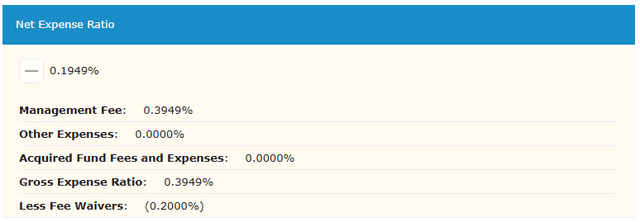

Expenses & Fee Waiver

BOXX is also a relatively expensive fund. While most treasury funds charge a single digit basis point expense ratio, BOXX charges considerably more for their complex options strategy. According to the prospectus, BOXX commands just under 40 basis points. However, BOXX shareholders are currently paying around half of this rate due to a fee waiver which expires in five months.

BOXX a fee waiver in place through January 2025, which reduced the fees to 19.5 basis points, a reduction of roughly 50 percent. Below is an outline of BOXX’s fees and expenses.

Bear in mind that with less than six months remaining on the fund’s fee waiver, the new fee will detract from BOXX’s total return relative to cheaper competitors. Since inception, SGOV has modestly outperformed in terms of gross total return. Should BOXX’s expense ratio double, the return discrepancy is likely to widen due to the increasing expenses.

Conclusion

Box spreads are the real deal as a proven options strategy. However, an investment in BOXX has hit a critical bump in the road. In a perfect world, BOXX would have further internalized their gains, preventing any tax exposure for sensitive investors. Instead, the fund passed through an August distribution, which was sent to shareholders. The unwelcome tax liability results in a degree of frustration from those who wished for BOXX to remain perfect.

Despite a blemish, BOXX remains ahead of a money market fund in terms of tax efficiency. For this reason, it earns a Hold rating. A traditional money market fund or an exchange-traded fund holding short-term treasuries, such as SGOV, is likely a better option for those who lack the extreme sensitivity to additional taxable income.