Snapchat has published a new report into the role it plays in the purchase cycle for consumer electronics, based on a study of 3,000 electronics shoppers across five markets.

And as you might expect (given the report was published by Snap), the data shows that Snapchat drives significant interest in electronics discovery.

As per the report:

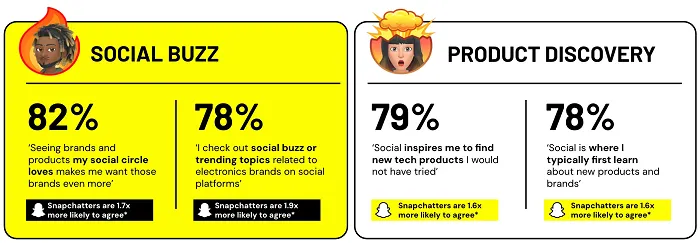

“From viral product drops to creator reviews, social platforms are a major catalyst in consumer electronics discovery. 78% of Snapchatters say social is where they typically first learn about new products and brands, which is 1.6x greater than non-Snapchatters.”

Look, I’m not saying this is not true, but I do question the methodology on this one.

As you can see in the examples above, the data is based on measuring how survey participants, including a subsection who identify themselves as Snapchat users, agree or disagree with each question.

So the survey question would be: “Social inspires me to find new tech products I would not have tried,” and based on how they answer, and the indicators of which apps they use, the data suggests that Snapchat users are 1.6x more likely to agree.

But the results would be relative to how many Snapchat users are in the sample group, what the audience make-up is, etc. Without that data, it could be, like, 12 Snapchat users among the 3,000 total participants, which would skew the data somewhat.

But even so, based on what we have here, it does seem like Snapchat users are more open to electronics discovery in the app.

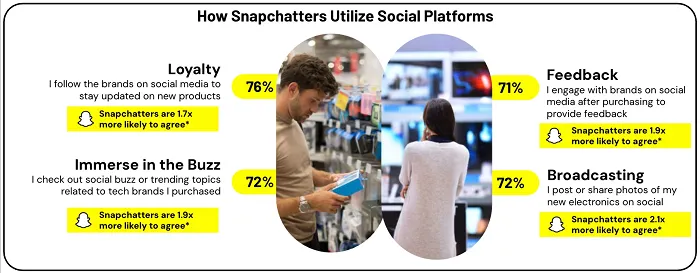

The data also shows that 60% of Snapchatters make purchases on social platforms directly from brand posts or ads, and 63% purchase via links on social platforms sent by friends and family.

Snapchatters are also more likely to engage with brand content, and share those updates.

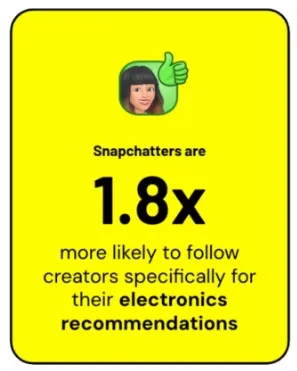

Snapchatters are also more likely to trust influencer content:

“75% of Snapchat users agree that they consider creator recommendations on social as trustworthy as those from friends and family, which is 1.8x greater than non-Snapchatters. In fact, 81% follow creators specifically for their electronics recommendations.”

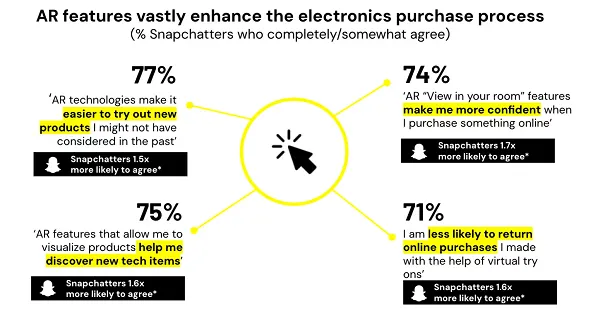

Finally, the report also looks at the role that AR experiences can play in electronics purchases:

These are all valid points, and the methodology makes sense. But I do find it strange that all of these AR indicators are almost the exact same audience response percentage for Snapchat-specific users.

That, to me, suggests that the Snapchat sample size here is relatively small, which is why it’s being presented as a ratio versus other apps, as opposed to showing a percentage of total respondents.

But those concerns aside, the data does suggest that Snapchat users are open to discovery and ads about consumer electronics, which could be another consideration for your marketing efforts.

You can read Snapchat’s full consumer electronics report here.